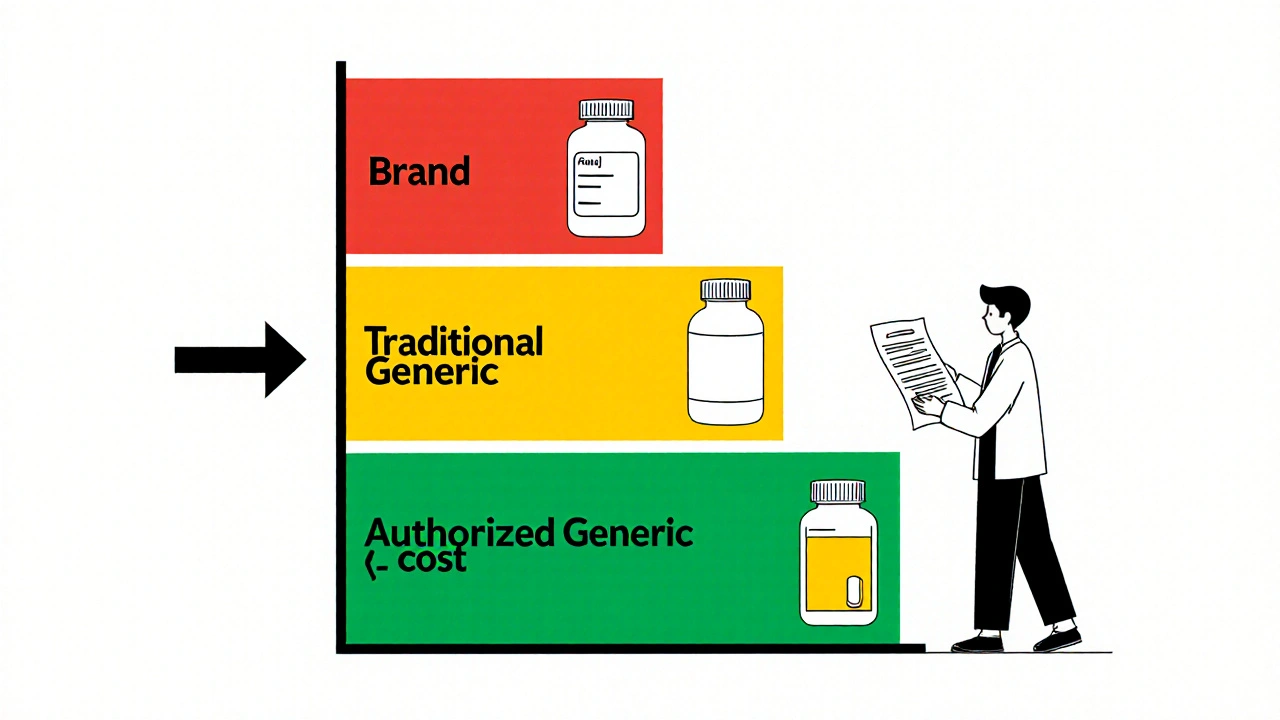

When you fill a prescription, you might not realize there are different kinds of generics on the shelf. One of them - the authorized generic - is the exact same drug as the brand-name version, made by the same company, but sold without the brand name. It’s not just cheaper. For many patients and insurers, it’s the best of both worlds: brand-quality medicine at generic prices. But here’s the catch: not all insurance plans treat it the same way. Where it lands on your plan’s formulary - the list of covered drugs - can mean the difference between a $10 copay and a $50 one.

What Exactly Is an Authorized Generic?

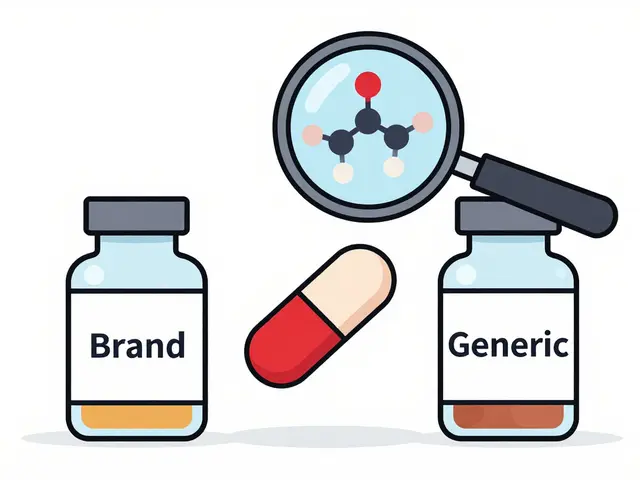

An authorized generic isn’t a copy. It’s the original drug, produced by the brand manufacturer, but packaged and labeled differently. You won’t see the flashy logo or the well-known name on the bottle. Instead, you’ll get a plain pill with the same active ingredients, same dosage, same manufacturing process - everything. The FDA defines it clearly: it’s the same product under the original New Drug Application (NDA), just sold under a different label.

This matters because traditional generics - the ones you see in bulk at Walmart or CVS - go through a separate approval process called an ANDA. They have to prove they’re bioequivalent to the brand. Authorized generics skip that step. They’re already approved. That means no guesswork. No risk of different inactive ingredients causing reactions. If your body reacts to the brand, it’ll react the same way to the authorized generic. And if you’re on a drug with a narrow therapeutic index - like Synthroid, warfarin, or seizure meds - that’s huge.

Why Insurers Care About Formulary Placement

Insurance companies care about cost. But they also care about safety and continuity. If a patient switches from a brand to a regular generic and has a bad reaction, the insurer ends up paying for ER visits, lab tests, and doctor visits. That costs more than the drug itself.

Authorized generics solve that problem. They’re therapeutically identical. So insurers can put them in Tier 2 - the same tier as regular generics - instead of Tier 3 or 4, where brand-name drugs sit. That means lower copays for patients and lower overall costs for the plan.

According to a 2022 study of 1,247 Medicare Part D plans, 87% placed authorized generics in the same tier as traditional generics. Only 12% treated them like brand-name drugs. That’s a big win for cost control. Plans with clear policies on authorized generics saved 7.3% per member per month on prescription spending. That’s not a rounding error. That’s real money.

How Authorized Generics Compare to Regular Generics

At first glance, they look the same. Both are cheaper than the brand. But behind the scenes, they’re different.

- Authorized generic: Made by the brand company. Same NDA. Same formula. Same factory. No bioequivalence testing needed.

- Traditional generic: Made by a different company. Must pass ANDA. May have different inactive ingredients. May have a 180-day exclusivity window before others can enter.

That difference shows up in coverage. For example, if you’re on Protonix (brand), the authorized generic is made by Pfizer. The traditional generic is made by Teva or Mylan. Your plan might cover both - but only if they know which is which.

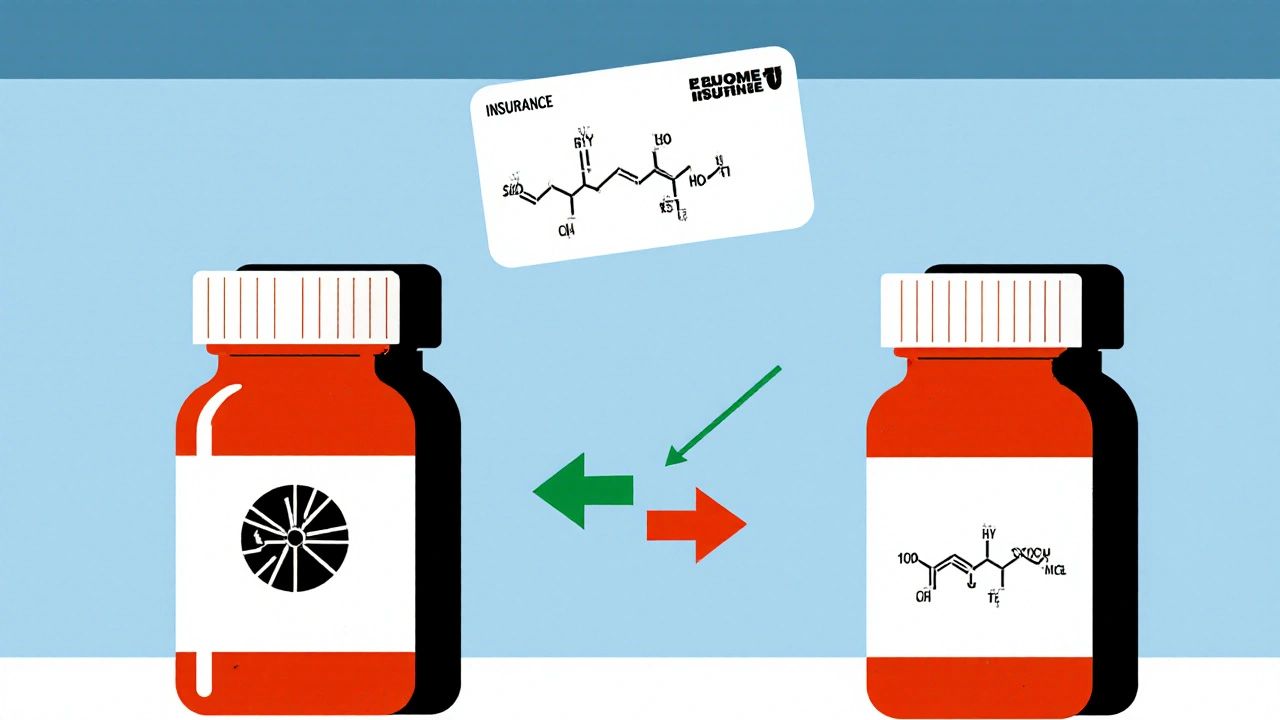

Here’s the problem: pharmacy systems don’t always recognize the difference. Authorized generics don’t appear in the FDA’s Orange Book, which pharmacists use to check substitutions. So if a pharmacist sees a brand name on the prescription and a generic on the shelf, they might assume it’s a traditional generic and substitute without checking. That can lead to denials or confusion.

Real Patient Stories: When Authorized Generics Make a Difference

One Reddit user, u/MedicationWarrior, shared how their insurance denied coverage for brand-name Synthroid - but approved the authorized generic immediately with a $10 copay. The brand was $50. They had a known sensitivity to the dye in the generic version. The authorized generic had the same inactive ingredients as the brand. No reaction. No hassle.

But not everyone has that luck. A 2022 GoodRx survey found that 34% of patients were confused when their pharmacy switched them to an authorized generic without telling them. Some got denied at the counter because the system didn’t recognize the NDC code. Others had to call their doctor to re-authorize the prescription.

Express Scripts reported that 89% of authorized generic claims were approved on the first try - close to the 92% approval rate for traditional generics. That’s good. But it’s still 3% lower. That 3% means real people stuck in pharmacy lines, frustrated, calling their insurers, missing doses.

Why Aren’t All Drugs Available as Authorized Generics?

Only about 15-20% of brand-name drugs have an authorized generic version. Why? Because it’s a business decision. Brand manufacturers don’t have to make one. They might wait to launch an authorized generic until after a traditional generic enters the market - to slow down competition. A 2021 Health Affairs study found that in 22% of cases, authorized generics delayed true generic competition.

It’s also more common in certain drug classes. Cardiovascular drugs? 28% have authorized generics. Oncology drugs? Only 7%. Why? Profit margins. Heart meds have high volume and stable demand. Cancer drugs? Complex, expensive, fewer patients. Not worth the hassle for the manufacturer.

As of October 2023, the FDA listed 147 active authorized generics. That’s not a lot, compared to the thousands of brand-name drugs on the market. So if your drug doesn’t have one, you’re stuck with either the brand or a traditional generic.

What Insurers and PBMs Are Doing About It

Pharmacy benefit managers (PBMs) are catching on. OptumRx launched an “Authorized Generic First” policy for 47 high-cost drugs in January 2023. Express Scripts added special flags to their formulary system in late 2022. CVS Caremark says it takes 30 to 45 days to update their system after a new authorized generic hits the market.

But the real shift is in policy. The 2022 Inflation Reduction Act is pushing Medicare Part D to prioritize lower-cost options. CMS projects a 15-20% increase in authorized generic coverage by 2025. And 68% of large employers plan to differentiate coverage between authorized and traditional generics in 2024 - meaning they might cover the authorized version at $5, but the traditional one at $15. That’s not just cost control. That’s incentive design.

How to Make Sure You Get the Right Coverage

If you’re on a brand-name drug and want to save money, ask your doctor or pharmacist: “Is there an authorized generic for this?”

Then check your plan’s formulary. Look for the drug name - not the brand. Authorized generics often appear under the generic name with a note like “(authorized generic)” or “AG.” If you can’t find it, call your insurer. Ask: “Do you cover authorized generics? What tier are they on?”

Pharmacists can look up authorized generics using the FDA’s official list or proprietary tools like Prime Therapeutics’ AG Tracker, which covers 98% of them. But you don’t need to know the system. You just need to ask the right questions.

And if your pharmacy substitutes without telling you? Speak up. You have the right to know what you’re getting. If your insurance denies the claim, ask for a manual review. Many denials are just system errors.

The Bigger Picture: Is This Good for Patients?

Yes - but with caveats. Authorized generics are a win for patients who need stability. They’re a win for insurers trying to cut costs without risking health outcomes. They’re a win for the system overall.

But they’re not a magic bullet. They’re a tool. And like any tool, they can be misused. When brand companies use them to block cheaper competitors, that hurts patients long-term. The FTC is watching. And if enforcement picks up, the market could change.

For now, if your drug has an authorized generic - and your plan covers it - take it. You’re getting the same medicine. You’re paying less. And you’re avoiding the guesswork that comes with switching to a traditional generic.

It’s not about being anti-brand. It’s about being smart about your care. And if your insurance doesn’t cover it yet? Ask them why. Change starts with questions.

Write a comment