Insurance Coverage: What You Need to Know About Prescription Drug Costs

When it comes to insurance coverage, the system that determines how much you pay for prescription drugs. Also known as pharmacy benefits, it’s not just about having a card—it’s about knowing what’s actually covered, what’s not, and how to fix it when it doesn’t work. Most people think if they have insurance, their meds are covered. But that’s not true. Many plans have high deductibles, step therapy rules, or only cover generic versions—even when the brand works better for you. And if you’re on Medicare, the gap between what you pay and what the plan covers can leave you paying hundreds for a single month’s supply.

That’s where Medicare Part D, the federal prescription drug program for seniors and people with disabilities. It’s the backbone of drug coverage for over 40 million Americans comes in. But Part D isn’t one-size-fits-all. Plans vary wildly in cost, formularies, and coverage gaps. Some charge $0 premiums but have high copays. Others have low copays but don’t cover your exact medication. Then there’s the Extra Help Program, a federal aid program that slashes out-of-pocket costs for low-income seniors. Also called Medicare LIS, it can reduce your monthly pill costs to under $5—with no deductible, no coverage gap, and automatic enrollment for many who qualify. Most people don’t apply because they think they earn too much—or they don’t know it exists. But the income limits are higher than you think. Even if you make $20,000 a year, you might still qualify.

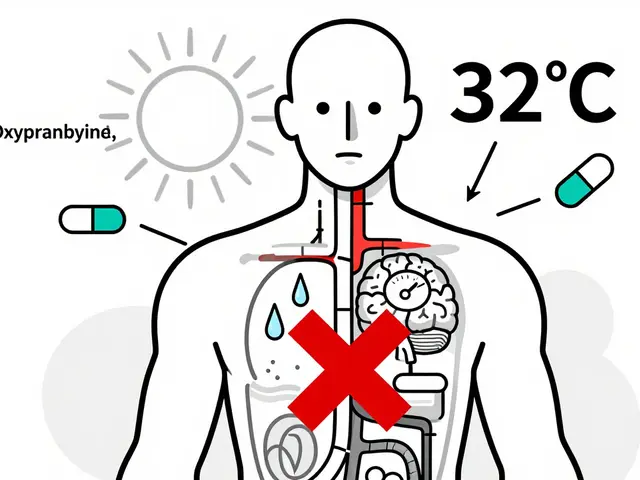

And it’s not just about Medicare. Private insurers, Medicaid, and even employer plans have their own rules. Some require you to try cheaper drugs first before they’ll cover the one your doctor prescribed. Others won’t cover certain generics unless you’ve been on them for six months. You can’t just rely on your pharmacist to catch it—you need to know your plan’s formulary, check your copay before you fill, and ask about patient assistance programs if you’re struggling. The insurance coverage system is built to be confusing, but you don’t have to be confused by it. The posts below show you exactly how to navigate it: how to prepare for your Medicare medication review, how to spot hidden costs in your drug plan, how to switch to cheaper alternatives without losing effectiveness, and how to get help when you’re stuck paying too much. These aren’t theory pieces—they’re real, practical steps people have used to cut their drug bills in half.

- By Percival Harrington

- /

- 16 Nov 2025

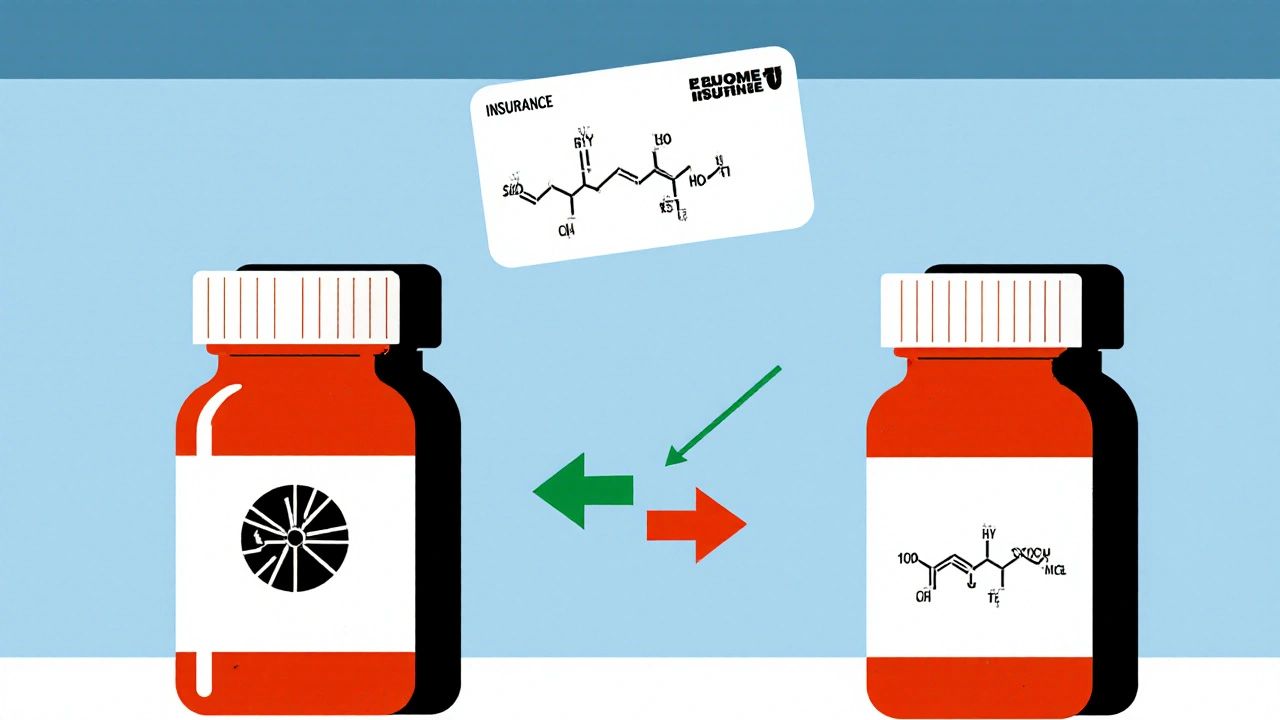

Insurance Coverage of Authorized Generics: How Formulary Placement Affects Your Prescription Costs

Authorized generics offer brand-name drug quality at generic prices, but insurance coverage varies. Learn how formulary placement affects your copays and how to ensure you get the best coverage.