Medicare Part D: What It Covers, How It Works, and What You Need to Know

When you’re on Medicare Part D, a federal program that helps pay for prescription drugs for people enrolled in Medicare. It’s not automatic—you have to sign up separately, and the plan you choose can save you hundreds or even thousands a year. Many people think Medicare covers all their meds, but that’s not true. Without Part D, you pay full price for everything from blood pressure pills to insulin. And if you wait too long to enroll, you could face a late penalty that sticks with you for life.

Drug formularies, the lists of medications covered by each Part D plan vary widely. One plan might cover your asthma inhaler with a $5 copay, while another charges $45—or doesn’t cover it at all. That’s why comparing plans isn’t just smart, it’s essential. Plans also have coverage gaps, often called the donut hole, where you pay more out of pocket after hitting a certain spending threshold. But since 2020, discounts and manufacturer coupons have cut those costs dramatically, so even if you hit the gap, you’re not stuck with full price.

Who needs this? If you’re on Medicare and take one or more prescriptions regularly, Part D isn’t optional—it’s a financial lifeline. Even if you think you don’t take much, a single new medication like a statin or a diabetes drug can flip the cost balance overnight. And if you’re on low-income subsidies, a program that lowers Part D premiums and copays for those with limited resources, you could pay as little as $0 for your meds. Many people don’t even know they qualify.

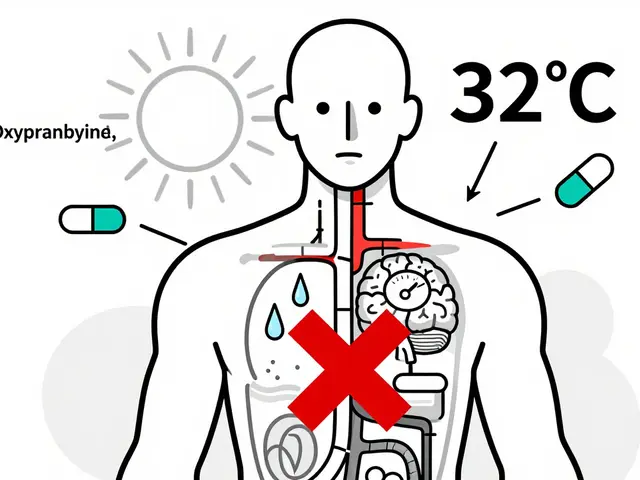

What you’ll find below are real, practical guides that connect directly to Medicare Part D. You’ll see how certain drugs like rosuvastatin or dipyridamole are covered—or not—by different plans. You’ll learn how insurance formularies affect your out-of-pocket costs for authorized generics, and why some medications require prior authorization. You’ll also find advice on managing side effects, avoiding drug interactions, and knowing when to appeal a coverage denial. These aren’t theory pieces—they’re written by people who’ve been there: struggling with high copays, confused by plan changes, or wondering why their doctor’s prescription got denied.

Medicare Part D is complicated, but it doesn’t have to be overwhelming. With the right info, you can pick a plan that actually works for your meds, your budget, and your life. Below, you’ll find the tools and real-life experiences that make the difference between paying too much and paying just right.

- By Percival Harrington

- /

- 17 Nov 2025

How to Prepare for a Medicare Annual Medication Review

Learn how to prepare for your Medicare Annual Medication Review to catch dangerous drug interactions, lower costs, and improve your health. Step-by-step guide for seniors on what to bring, what to ask, and what happens next.

- By Percival Harrington

- /

- 14 Nov 2025

Extra Help Program for Low-Income Seniors: How to Qualify for Prescription Drug Savings

Learn how low-income seniors can qualify for the Medicare Extra Help Program to cut prescription drug costs to just a few dollars per pill - no premiums, no deductibles, and automatic enrollment for many.